Be prepared to deliver evidence of earnings as a result of pay stubs, tax returns, or bank statements. It isn't really just about the amount you make but in addition your debt-to-profits ratio, which compares your month to month financial debt payments in your profits.

The convenience of acquiring a $four,000 loan depends upon your credit score score, money, and the lender’s prerequisites. It’s essential to shop all around and Assess rates to find the ideal conditions in your circumstance.

No matter whether you might have excellent or poor credit rating, TriceLoans considers several components over and above just your credit score score. The online lender offers private financial loans with instant acceptance and rapidly funding, catering to borrowers with diverse credit rating backgrounds.

TD Bank doesn’t cost origination or application fees, and there isn't any prepayment penalties. Nevertheless the lender doesn’t provide a lot of options for the length within your mortgage and will not provide loans in your condition.

We do not make lending selections, nor can we conduct credit score checks. Nevertheless, the lenders who review your software may perhaps execute a tough credit history check to evaluate your creditworthiness, which could effect your credit rating.

First off, fascination premiums are a massive factor. They can vary broadly among lenders, so It is really vital to compare premiums. Keep in mind, even a small change while in the desire amount can have a giant impact on your every month payment and the overall quantity you can pay back back.

Lenders will examine things such as your income and work standing to find out your power to spend. The more cash you need to borrow along with the fewer revenue you get paid, the slimmer your options for no credit Verify financial loans turn out to be.

Though settling your $four,000 mortgage in advance might appear useful, be mindful of likely prepayment penalties that your lender might demand. Prepayment penalties are expenses imposed by lenders for early repayment of all or maybe a part of the mortgage.

Reduced interest prices: When compared to charge cards, these loans might get more info have lower charges, conserving you funds as time passes.

Contrary to common avenues similar to a lender or maybe a credit union, in which the procedure might be extra stringent, specialists really propose utilizing an internet System for its advantage.

A robust loan software can greatly boost your possibility of securing a $four,000 particular financial loan. This involves acquiring the required documentation set up, such as legitimate identification and evidence of earnings.

This gets rid of the need to check out a Bodily branch, hold out in traces, or take care of considerable paperwork.

Many factors will need contemplation when considering a $four,000 personalized loan. It could support in funding important expenditures and will potentially boost your creditworthiness as a result of frequent repayments. On the other hand, it might catch the attention of increased curiosity premiums, specially for all those with reduced credit rating scores.

By using a payday personal loan, be prepared to include the charges and pay back it off quickly. If you’re unable to pay over the owing date, you’ll be billed far more charges and additional curiosity, which can swiftly increase the overall Expense within your financial loan.

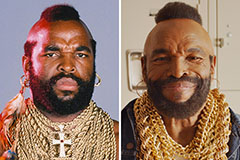

Mr. T Then & Now!

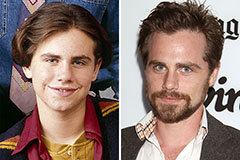

Mr. T Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now!